The internet is the best place to look at when looking for the best payday loans, and the reasons are not far-fetched. One, the internet plays host to hundreds of online lenders that you can easily contact for payday loans with competitive interest rates. Secondly, you will also be able to review the track record and performances of these payday loan lenders before choosing a lender to work with.

The loan market in the United States is highly competitive, making it overwhelming to choose the best payday loan online with guaranteed approval. So, in this article, we will review the top 5 payday loans brokers to enable you to make an informed decision. But before we dive in, let’s quickly walk you through what payday loans are and the criteria to obtain one

What Are Payday Loans?

Payday loans are unsecured short-term loans that lenders offer to borrowers to be repaid on your next paycheck. Payday loans come with a high interest rate and do not require any form of collateral.

Eligibility Criteria

To qualify for payday loans, you must meet the following requirements:

- You must be at least 18 years old.

- You must be a resident in the US.

- You must have a valid email and checking account.

- You must possess a valid means of identification.

- You must have a verifiable source of income.

Top 5 Payday Loans Online With Guaranteed Approval

The following are the top 5 payday loan brokers with guaranteed approval:

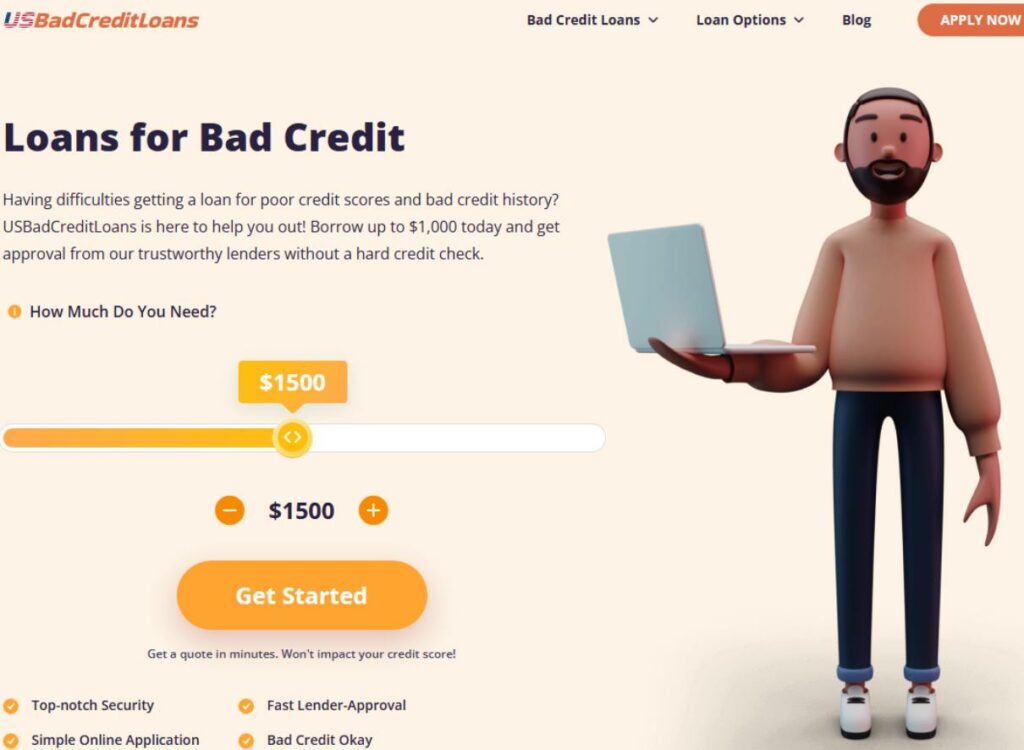

5. US Bad Credit Loans

US Bad Credit Loans is another giant when it comes to linking borrowers to trusted online lenders. US Bad Credit Loans partners with at least 50 lenders to offer different types of loans to borrowers. Whether you have a bad credit score or not, this payday loan broker will accommodate your request, provided you have a stable source of income. The customer support representatives are well-trained. They will hold you by the hands and walk you through every difficult stage.

Why Choose US Bad Credit Loans?

- US Bad Credit Loans offers instant loan approval

- They charge zero origination fees.

- The application process from start to finish is done online

- They cater to borrowers with poor credit rating.

Do these payday loan lenders consider a bad credit rating?

Of course, they do. Whether you have a bad credit rating or not, you can send in your application and you will receive the amount that you need instantly.

1. WeLoans

WeLoans is a top-rated payday loan broker with the capacity to offer up to $5000. It’s specifically designed for those with bad credit ratings. If a traditional financial institution has turned you down due your poor credit history, you can count on WeLoans to offer you the amount that you want.

Why Choose WeLoans

- WeLoans offers a high approval rate

- This broker partners with over 50 credible direct lenders

- Competitive interest rates.

2. iPaydayLoans

iPaydayLoans is a leading online payday loans broker whose job is to connect borrowers with genuine and legit lenders that will approve the amount requested. Whether you need a loan to renovate your old apartment, or you want to pay your children’s tuition, you can rely on iPaydayLoans to get the amount that you need.

The application process is simple and straightforward. Once you meet all the requirements as stated on the broker’s official website, you can proceed to apply for the payday loan. The broker will link you to a lender that you will you up to $5000. Go and visit this page to apply for payday loans.

Why Choose iPaydayLoans?

- iPaydayLoans does not charge processing fees.

- Their interest rate is highly competitive.

- Over 60 credible lenders.

- Accessible on multiple browsers.

3. HonestLoans

HonestLoans is another great lender that you can rely on to get up to $5000 in payday loans. The application process is seamless. You will need to visit the official website of the broker, summit for loan application, and wait for the broker to pair you with a lender. In turn, the lender will offer you a number of loan options, which you need to thoroughly review before choosing an option. Once you sign the dotted lines, the loan will be credited into your checking account instantly.

Why Choose HonestLoans?

- HonestLoans is user friendly and accommodates people with bad credit.

- Their lending platform is highly protected.

- Quick loan approval.

4. USInstallmentLoans

USInstallmentLoans is respected across the US loan market as it caters to borrowers who need installment payday loans. Applying for a payday loan online on this brokerage platform is absolutely free with no hidden charges. Once your submit your loan application on the USInstallmentLoans portal, the lender will review your application, and if you meet the requirements as stated on the broker’s website, the amount requested will be credited into your checking account.

Why Choose USInstallmentLoans

- USInstallmentLoans accepts bad credit

- Only has basic eligibility requirements.

- They have a responsive customer support desk

- They partner with over 60 credible direct lenders.

Summary

Nowadays, Americans are now turning to online payday loans for relief, especially when they run out of cash before payday. Payday Loans are unsecured short-term loans with a high interest rate. The 5 payday loan brokers that we reviewed above will accommodate your loan request and match you with lenders that will fund your checking account instantly. The application process for all the 5 brokers are basically the same, only that you must fulfill their requirements to access payday loans.

Still in doubt on the payday loan broker to choose? Then we recommend iPaydayLoans. This broker has what it takes to help you secure up to $5000 before your payday. Plus, you will get up to 18 months to repay the loan and interest.

Frequently Asked Questions

What are the factors for choosing a payday loan lender?

There are so many factors you need to consider before choosing a payday loan lender, including interest rate and fees. The interest rate and fees that a lender charges can quickly add up to the total amount that you will repay if you take a payday loan online. Therefore, before settling for a payday loan broker, it is important to review the interest rates and the fee that the broker charges; otherwise, you will end up spending more to service the loan.

What makes these 5 brokers outstanding?

The loan brokers listed in this article are unique in their own merit. They all have a supportive and responsible customer support desk. The customer support desk has a variety of ways to reach them, including social media, live chat, email, and phone numbers. Additionally, their security is top-notch. Your personal and financial details are secure with them.